Every business, large or small, wants to grow. But growing too fast can put a strain on your company’s financial, operational, and personnel resources. The result could be a disaster for the future of your business. After all, ⅔ of the fastest growing companies fail! Give your company a chance to be in the ⅓ that succeed by carefully considering these 7 key metrics before making expansion plans.

1. Revenue Per Person

Revenue Per Person is a simple equation — annual revenue divided by number of full-time employees.

While the “average” small business has an RPP of about $100,000, that number can vary widely based on industry, company size, and stage in the company’s life cycle. For example, Apple’s RPP is $2.7 million per employee!

You’ll have to do some industry research to establish a “good” RPP for your company, and to determine how you match up. Some good resources include D&B Hoovers and Statista.

2. Net Promoter Score

Photo Credit : teamsupport.com

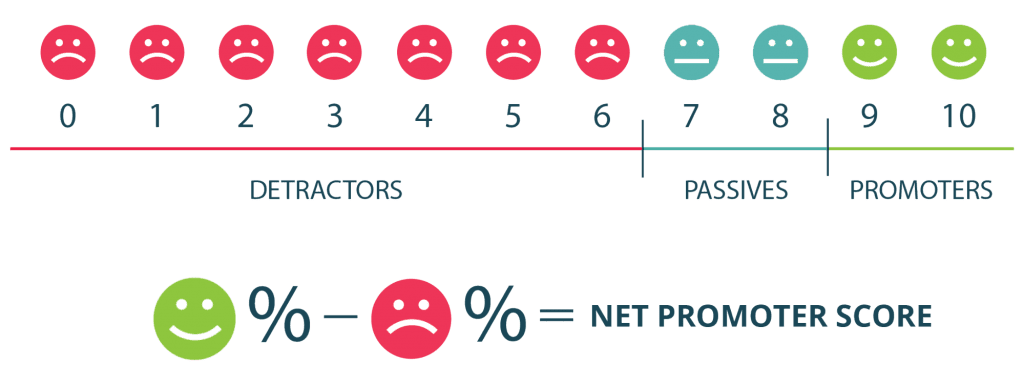

Your “net promoter score” is a measure of your customer’s loyalty to your product or brand. To determine your net promoter score, ask your customers one simple question: “On a scale of 0-10, how likely is it that you would recommend [company] to your friends, family or business associates?”

Customers who respond with:

- 9 or 10 are “promoters”

- 7 or 8 are “passives”

- 0 and 6 are “detractors”

To calculate your overall score, determine the percentage of respondents who were detractors and the percentage who were promoters. Then subtract the percent of detractors from promoters. Research has shown that a high net promoter score can be a signal of future growth. Note that in industries where there isn’t much competition, a net promoter score will not be a reliable metric.

3. & 4. Customer Lifetime Value (LTV) & Cost of Acquiring Customers (CAC)

These two metrics are so intertwined that we’re going to consider them together. LTV is an estimate of the revenue a customer will generate throughout your entire relationship. A low LTV could indicate that your customers are not loyal to your business.

CAC, or the cost of acquiring customers, can vary greatly depending on your industry and business model. This is why rather than considering LTV or CAC on their own, it’s best to look at the two numbers together.

If it costs your company $50 to acquire a new customer, and their estimated LTV is only $40, you will lose money over time. But if your customer’s LTV is $5,000, that same $50 CAC will put you in a great growth position.

There are two ways to improve this ratio — increase customer loyalty or decrease CAC. A 5% increase in customer retention can increase profits by as much as 95%, so it could be well worth it to focus on improved customer service!

5. Customer Churn

Churn is the number of customers that end their relationship with your business over a period of time, divided by your remaining customers.

While churn is easy to track for businesses on a recurring or subscriber model, it can be a little more complicated for retail or eCommerce businesses. But however it’s tracked, the most important thing is this: does your growth rate exceed your churn rate? If not, decreasing churn may be more urgent than growth.

6. Gross Margin

Beyond a simple measure of your company’s production efficiency, gross margin can also indicate your company’s resistance to market fluctuations. If margins are tight, your business could be vulnerable to a rise in material costs or a small increase in churn.

A wider margin will provide your company with the extra capital you’ll need for growth initiatives, while also providing a safety net in the event of market changes.

You should know the average margins in your industry, but if you don’t, this dataset is a good place to start.

7. Cash Flow

One of the top reasons that small businesses fail according to the SBA is “inadequate cash reserves”.

It’s tempting to be optimistic that as soon as X happens, your cash flow will right itself. But any growth initiatives are going to require additional financial investment, whether it’s in equipment or staff. So tighten up your billing practices and make sure invoices are being sent out ASAP to get that cash in hand.

Get Ready to Grow!

If you find that certain numbers aren’t where they should be, spend some time on improvements before rolling out new programs or hiring more staff. And continue tracking these metrics to monitor your company’s health as it continues to grow!